When you begin your own homebuying travels, you’re going to manage particular quite large numbers. For the majority of Experts, those individuals amounts is somewhat intimidating.

Talking to an excellent Va financial regarding the financial value was constantly an intelligent 1st step within the homebuying process. However, strong equipment exist that take away the loan places South Fork concern about purchasing a home you can not manage, and you can this will provide you with a sensible concept of exactly how far Va home loan you really can afford.

In order to be eligible for a mortgage that fits your personal and you will monetary demands, type in your details to choose just how much household you can afford with this particular easy Virtual assistant mortgage cost calculator.

Just what Circumstances Decide how Much House You can afford Having an excellent Virtual assistant Mortgage

As the an experienced, you get entry to many powerful home loan equipment available today – the brand new Va mortgage, and there’s a quantity of tranquility inside the focusing on how far family you really can afford.

However,, qualifying having a good Va financing will not verify you get a mortgage otherwise pick a house you might comfortably easily fit into your financial budget. Very, why don’t we look at around three crucial areas you to definitely factor on the fresh new calculation away from Virtual assistant home loan cost.

Income

The gross income can be your total shell out in advance of write-offs and helps decides exactly how much home you can afford. Unless you are able to afford a property for the cash, you will need a steady earnings to make their monthly mortgage repayments.

Lenders will need to guarantee earnings giving duplicates of your W-2’s, spend stubs, 1099s, impairment honor emails, evidence of self-a position plus.

Loans Payments

The complete monthly personal debt payments along with play a life threatening part in domestic cost. Bottom line more month-to-month obligations Veterans bring, new more challenging its so that they can pay their bills easily.

Your debt-to-money proportion (DTI) allows you to see a little more about the full month-to-month debt and you can family affordability, hence we are going to safety in detail after.

Credit history

VA-supported mortgage loans have no minimum credit score criteria. not, which have a lesser credit history, you can easily shell out a top rate of interest and costs that could raise your month-to-month homeloan payment.

Lenders make use of credit history to check the number of monetary obligations. The greater number of economically in charge youre, the more likely youre and also make the mortgage repayments toward date.

For those who have less-than-prime borrowing, lenders you are going to believe you a good riskier borrower and you will charge you way more getting a mortgage.

As to the reasons Your own DTI Is very important getting Cost

The debt-to-money ratio ‘s the relationships involving the money as well as how far you spend per month on loans. Eg, in the event your complete monthly loans are $720 along with your monthly income try $dos,100, their DTI would-be thirty six %.

Full month-to-month obligations (lease + car payment + mastercard fee + education loan payment) / Terrible month-to-month income = Debt-to-money proportion ($1,200 overall personal debt / $4,five hundred gross income = 0.26 otherwise twenty six percent).

Remember very Virtual assistant loan providers just use effective consumer costs that show upon your credit report so you can estimate your own total monthly debt. Atlanta divorce attorneys case, VA-recognized loan providers would not play with loans just like your cellphone expenses, auto insurance, medical insurance premiums or utility bills so you’re able to calculate your DTI.

The Virtual assistant recommends that loan providers limit the DTI from the 41 %. Although not, the newest Virtual assistant does not provide the real financing, it is therefore as much as lenders to utilize her rates in order to build loans.

In the event your DTI is higher than 41 percent, you may shell out a higher rate of interest or pay more fees. By paying more 41 percent of one’s revenues for the monthly personal debt, hook downwards shift on your own shell out you can expect to seriously damage the long-term homes finances.

Difference in Front-Prevent and you can Back-Stop DTI

You really have heard of brand new terms and conditions front-prevent and you will back-stop personal debt-to-money rates. But, you do not be aware of the difference in the two and how it impact the DTI formula.

The top-avoid DTI will be your construction expenditures, just like your payment per month, possessions fees and you will homeowners insurance divided by the income.

Though loan providers avoid using it proportion to be considered you, it’s still important in working out for you figure out how much household you really can afford.

A standard rule of thumb can be your front side-end DTI shouldn’t surpass twenty eight-30 %. Although this code is not devote brick, it is a great benchmark in order to calculate your own Virtual assistant house mortgage cost.

The back-prevent DTI proportion works out simply how much of your revenues happens toward other types of financial obligation such playing cards, student education loans and you will car loans. An in the past-avoid proportion significantly less than 36 per cent is generally preferred, however, this will are very different according to the financial.

Why Score Preapproved for your Va Financial

Regardless if you are offered good Virtual assistant financing, conventional home loan, USDA loan otherwise a keen FHA mortgage, getting preapproved is a significant milestone on the homebuying journey.

A good Virtual assistant financing preapproval was a loan provider letting you know simply how much financing your be eligible for. From the housing industry, a great preapproval reveals agents and suppliers you may have severe to purchase stamina. Acquiring your Va financing preapproval just before home-browse may also leave you a better idea of exactly what groups regarding house you can afford.

To locate a great Virtual assistant financing preapproval, you will have to bring lenders which have records of one’s employment record, military services, and other necessary data to choose your own qualification. Loan providers will then ask for their consent to pull their borrowing from the bank get.

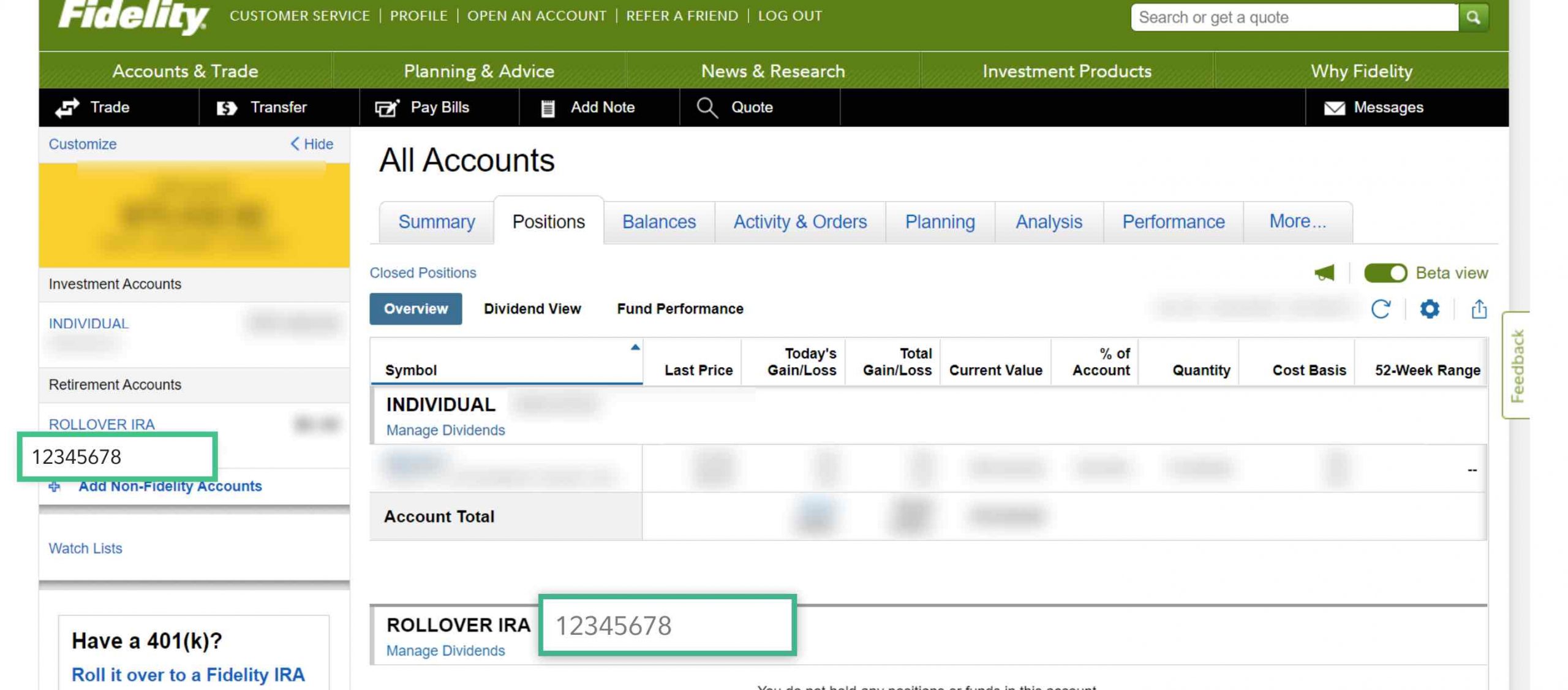

If the credit score meets the brand new lender’s standards, you may then promote proof of income or other appropriate data files oriented in your current economical situation. Data you’ll become bank comments, W-2s, disability prize emails plus.