Tsp Finance

Borrowing from your later years fund may suffer counterintuitive. Its, anyway, among metropolises you put your bank account to store they to own when you need it. But possibly the means, plus the timing of them, improvement in means we didn’t invited whenever we began adding to our Thrift Discounts Plan (TSP).

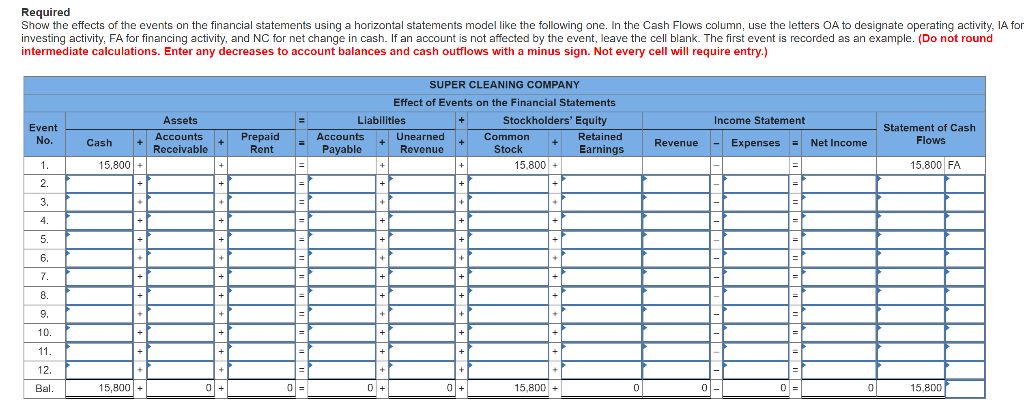

Would be to one happens, you do have the ability to borrow cash from your own Tsp. There have been two sort of loans for the plan available to government professionals, including numerous possible reason this may make sense for someone to obtain for example that loan. It is all dependent upon your Teaspoon harmony, the almost every other financial situations, and you will what is right for you, all your family members, along with your future.

Exactly how Tsp Financing Really works

For people who satisfy specific loan qualification regulations (understand the point towards Tsp Loan Eligibility below) along with your financing request is eligible, the amount of your loan is really taken from your Tsp membership by borrowing specifically in the contributions and you will earnings you’ve made for you personally. Your loan amount you should never meet or exceed the level of your benefits as installment loans Cleveland no credit check well as their money, and also you do not acquire from people matching contributions otherwise money accumulated from the relevant agency otherwise solution.

This type of fund is paid back by way of write-offs to each of the paychecks so you’re able to fix the level of the loan and relevant focus for your requirements. If you can’t repay the mortgage, it gets taxable earnings and you will likely incur charges and you will charges.

The pace on your own Tsp loan stays similar to the G Funds speed at that time your loan software is canned, and this speed is fixed with the life of the mortgage. No matter if desire on your own loan isnt taxation-allowable, the desire happens directly back into your Teaspoon account. Each and every day interest in your loan try computed just like the for every single commission produced returning to its printed, that will be centered on a variety of the quantity ofdays given that the last mortgage commission, plus a fantastic financing balance.

General-purpose Financing

There have been two type of Teaspoon fund you could take. The foremost is entitled a standard Objective Mortgage, therefore music largely as the identity suggests. A broad Purpose Loan are used for any reason you attract, and there’s zero certain records of the obtaining so it loan. Just what meaning is, this new Tsp doesn’t inquire that which you plan to create having the cash you obtain from your own membership undergoing applying for a standard Objective Financing.

An over-all Purpose Loan would be to own ranging from step 1 and you can five years-you could potentially elect how much time you want to decide to try pay it back contained in this that windows. Your loan money has to start in this two months of your loan getting taken to you.

Residential Funds

Next sort of Teaspoon mortgage available is a domestic Loan. This is certainly financing you specifically take-out to simply help your own first place of house. Which could is adding to the purchase of one’s number 1 home, or even for framework of first house. You could just take anywhere between 1 and you will fifteen years to expend straight back so it financing.

A residential Financing means particular data your assets the mortgage will be useful try, in reality, your primary house. Provided the loan is for your primary home, you can use it to possess a beneficial:

You may not fool around with a residential Mortgage in order to refinance or shell out your financial, include a choice towards newest top household, remodel your household, get just home, otherwise purchase aside someone’s show on your number 1 quarters. As the Domestic Financing are not noticed mortgages, your notice isnt deductible in your income tax go back. The loan payments far including begin inside 60 days of amount borrowed getting taken to your.